About

Our focus is emerging healthcare professionals

Serving emerging healthcare professionals is our specialty. We understand the magnitude of what you have accomplished; moreover, we understand why you’ve done it. Our aim is to partner with dental and medical professionals, like yourself, to develop a plan which not only celebrates your hard work and discipline but leverages it.

Student loan repayment strategy

The student loan repayment strategy you choose can affect every aspect of your financial life. Therefore, we believe it is important that you address your repayment strategy within the context of an overall financial plan. That’s where we help!

Our team of experienced and licensed financial professionals will help you create a smart, cost-effective plan to tackle your student loan debt in the context of your career aspirations and other important financial planning issues. As you transition into residency or your career, we feel you will find it extremely helpful working with a team of experienced professionals who understand the specific needs of emerging healthcare professionals.

A team of experienced professionals who understand your specific needs

The student loan repayment strategy you choose can affect every aspect of your financial life. Therefore, we believe it is important that you address your repayment strategy within the context of an overall financial plan. And, that’s where we can help.

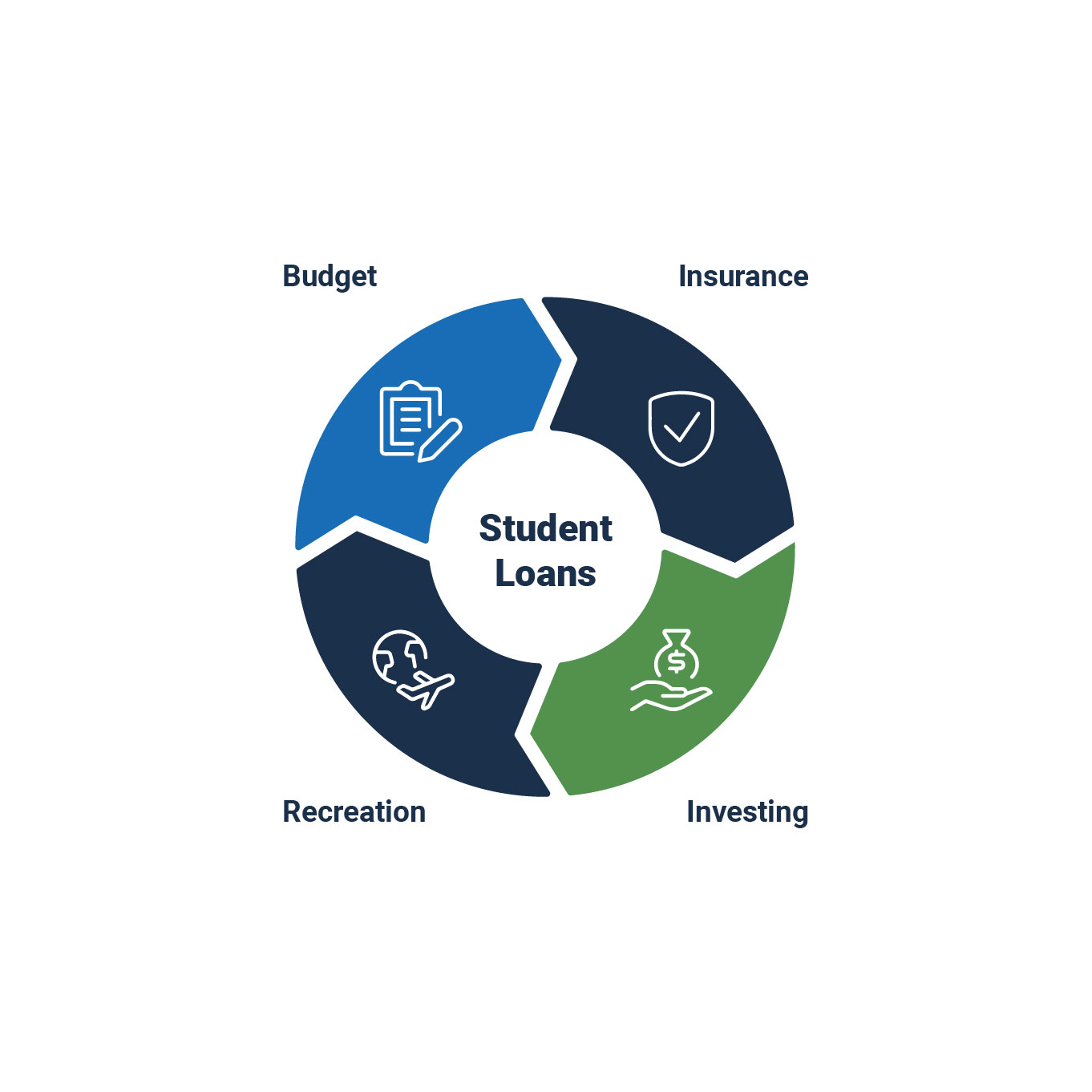

Our 360-degree approach

We help you navigate the complexity of student loan repayment planning within the context of an overall and evolving financial plan. Student loan repayment planning should not be considered a transaction, one-time event, nor in isolation from the other important financial issues you will need to address as you transition into residency or your career.

In addition to developing a smart student loan repayment strategy, you will be making financial decisions on topics like: living expenses, insurance needs, saving and investing for the future and perhaps practice ownership.

Initially after graduation, you will likely be an associate as you enter your career. But, perhaps one day you wish to be a practice owner or a partner in a practice? Or maybe your plan is to work in public health, at least until your student loans are forgiven? Each of these scenarios provide unique planning opportunities with respect to your student loan repayment strategy.

- Should you enroll in an income-driven repayment plan-IDR? If so, when and which IDR? There are two primary IDR’s to consider.

- How long should you stay on an IDR, 20 or 25 years? Hopefully not!

- Should you refinance your federal student loans immediately upon graduation or should you wait a couple of years until you are settled in your career?

- How do prevailing interest rates play into your repayment strategy?

- If I start a family or buy a practice, how does this impact my repayment strategy?

Our team of experienced and licensed wealth advisors will help you create a plan that will help address all of these issues from graduation throughout your evolving life and career.

StudentLoansRx Team

Planning Packages

We partner with you to help make your whole financial picture successful

Our focus is emerging dental and medical professionals just like you. We understand the magnitude of what you have accomplished, and we want to help you build a plan that will leverage all your hard work and discipline.